What is Immediate Financing Arrangement? The Immediate Financing Arrangement is a financial strategy that allows both individual and corporate business owners to get the permanent life insurance coverage they need while still saving money to invest in their company. The policy is used as collateral for obtaining a loan or line of credit from a financial institution in this strategy. Additional assets may be required in some cases to obtain a loan. The loan proceeds are invested in a business or other revenue-generating venture, and the interest paid may be tax-deductible. When a policy is used to secure a collateral loan, the interest expense, as well as some or all of the policy premiums, are tax-deductible. When the life insured passes away, the outstanding loan balance is deducted from the death benefit in accordance with the insurance policy. The corporation is considered the owner and ultimate beneficiary of the insurance policy if the owner is associated with an incorporated business. According to current tax laws, the company will receive proceeds from the tax-free policy as well as credit to its CDA (capital dividend account) upon the death of the insured business owner. Capital dividends are also paid to shareholders tax-free by adhering to pre-established protocols of the Canadian Income Tax Act.

Mechanism of the Strategy: A typical insurance transaction consists of three steps: the insured submits a life insurance application, the application is approved, and the premiums are paid. All benefits are directly transferred to the beneficiary upon death, and premium payments are halted.

In the case of an IFA, the associated policy’s premium is deducted from the cash flow. To compensate for the cash flow, an insurance policy is used as collateral. The money borrowed is invested in businesses, land, real estate, and other profitable ventures.

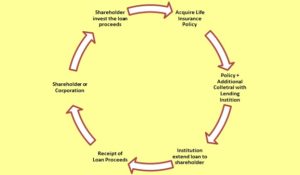

With the help of a corporation or shareholder as an example, the entire process can be easily understood. Assume a company shareholder buys a $2,000,000 life insurance policy with an annual deposit of minimum of $30,000. Upon death, the beneficiary will receive over $2,000,000 due to an increase in death benefit each year. The owner is willing to pay cash for the premium but prefers to keep the premium amount, $30,000, in the business. The following is how the strategy will be framed:

The following expenses become tax-deductible when the policy is well-managed:

Tax Reduction Benefits: Today, everyone is looking for ways to save money on taxes, whether through tax deferral or tax elimination. In both cases, the strategy is beneficial. Investment gains in a life insurance policy are tax-deferred. The investment gains, on the other hand, are lost when the insured dies, and the majority of the death benefits are tax-free for the beneficiary.

The Bottom Line: For clients who are healthy and financially secure, a strategy is an excellent choice. It is beneficial to both individuals and businesses. The client must be a shareholder in a successful business and be looking for permanent life insurance at the same time. The client’s business must have a significant annual surplus or a high percentage of earnings retained from taxable investments. If a client is looking for funds to expand his business empire or other income-producing assets, this strategy will work best for him if he executes the strategy properly.

© Copyright 2024 Boss Financial, All Rights Reserved.

Designed & Developed by Altastreet.